PriceFree

This is a reading activity for CPD purposes. Some GPs might complete this activity in a shorter time. This CPD reading may be self-recorded as 3 hours of RP activity in your RACGP record.

This presentation aims to help GPs

-

minimize the risk of being audited,

-

improve Medicare compliance,

-

prepare for audits,

-

and increase the likelihood of achieving favourable outcomes.

I’m Paul Soloviev, a consultant with 25 years of experience in General Practice. In this presentation, I want to share some insights about Medicare audits that I’ve encountered over the years. Please note that this is not legal advice but rather a recollection of my experiences.

General Practitioners (GPs) often work as subcontractors or tenants in medical practices. They receive a percentage of their billings, while the remaining funds go towards running the practice. This split can be, for example, 30/70% or 35/65%. Naturally, GPs are interested in higher Medicare billings, and some may be tempted to bend the rules for higher profits.

Throughout my career, I’ve been by the side of doctors who were audited by Medicare. As part of my consulting service, I’ve helped these doctors draft letters, discuss strategies, and prepare materials. I’ve also accompanied them during hearings at Professional Services Review and AHPRA. I’ve witnessed the significant psychological impact that these audits have had on most doctors.

You can find additional free resources on Medicare billing on this website.

Always check the Medicare item descriptors using MBS Online for accurate information.

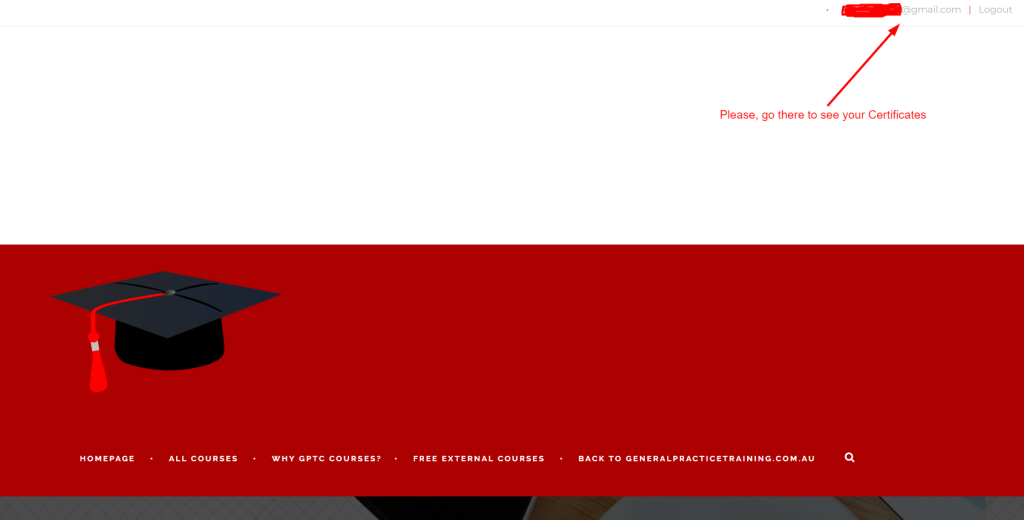

Where can you find your Certificate?

More free resources for GPs and Practice staff at General Practice Training and Consulting.

Section 1Dealing with Medicare audit

Lecture 1Foreword

Lecture 2Table of contents

Lecture 3What is a Medicare audit?

Lecture 4How GPs become the subject of Medicare audit?

Lecture 5Random Medicare audit.

Lecture 6Random Medicare audit via correspondence or a visit.

Lecture 7Random Medicare audit via correspondence or a visit. Peer review.

Lecture 8Medicare audit due to any areas of concern by Medicare.

Lecture 9Medicare audit due to any areas of concern by Medicare. (cont.)

Lecture 10How to avoid being audited?

Lecture 11How to minimise the risk of being audited?

Lecture 12How to minimise the risk of being audited? (cont.)

Lecture 13How to minimise the risk of being audited? (cont 2.)

Lecture 14How to minimise the risk of being audited? (cont.) How GPs end up in prison?

Lecture 1523 or 36 or 44. The ‘tricky’ items.

Lecture 1623 or 36 or 44. Is there a ‘golden formula’ for ‘safe’ billing?

Lecture 17Billing Medicare items for ‘Unrelated’ services.

Lecture 18Number of patients seen.

Lecture 19Consistently billing ‘favourite’ items in significant numbers.

Lecture 20Care Plans, Assessments, Mental Health Plans – how many is too many?

Lecture 21Care Plans and Mental Health Plans – wrong pattern.

Lecture 22Home visits – wrong pattern.

Lecture 23You have received the letter of audit. What to do?

Lecture 24The first response is the most important in dealing with the audit. How to produce the first response.

Lecture 25The first response did not work. What is next?

Lecture 26Things got worse – you are in front of PSR (Professional Services Review). What to do and what not to do.

Lecture 27Medicare proposed the ‘punishment’. It is not the end of the game. Your options.

Lecture 28You have reached an agreement with Medicare. What is next? How to reduce the impact of the ‘penalty’.

Lecture 29Where to find help? Indemnity insurance, consultants. What to expect?

Lecture 30Thank you for completing this CPD activity

Leave a Reply

You must be logged in to post a comment.